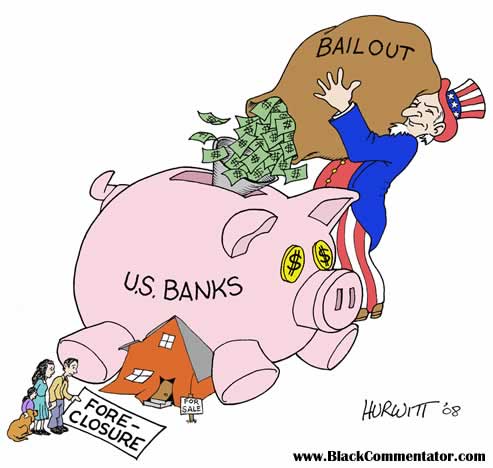

Last weekend, U.S. President George W. Bush sent Congress a $700 billion bailout proposal for the financial sector, in addition to the $285 billion from the Federal Reserve for mortgage lenders Fannie Mae and Freddie Mac. The requested money is intended for the discretional and uncontrolled acquisition, by the Treasury Department, of bad assets and debts and expired portfolios, especially in the housing sector. To put it in laymans terms, the Bush initiative means that the state acquires private debts and distributes them among the general population, which represents a per capita debt of two thousand dollars.

The audacity of the request has shaken Washingtons political sector, because it is obvious that, under the aegis of the proposed bailout, hundreds of billions of dollars of public funds would disappear in a bottomless pit of corruption, favoritism, and complications, just like what occurred in Mexico a decade ago, when the Zedillo administration orchestrated the salvation of private banking with the general publics money. Whats more, the White House already has a precedent of unscrupulously managing multimillion dollar sums destined for the war in Iraq, a large portion of which have gone toward the establishment of suspicious or nonexistent contracts benefiting corporations from deep within the presidents circle, particularly Halliburton, of which Vice-President Dick Cheney was CEO. Amidst the upheaval, came ringing rejections of the plan by Democratic presidential candidate Barack Obama, and even Republican John McCain, who has been encouraged to distance himself from the corruption, inefficiency, and bungling of the current administration, headed by his party mate.

A third element explaining reservations to the plan is the arrogance and despotism with which it was presented lacking a single justification, program, or any criteria for the application of the funds in what constitutes the actions of a president accustomed, since September 2001, to acting without counterbalances, running ramshod over basic rights, and to whom the judicial and legislative branches have granted all manner of special powers under the pretext of fighting terrorism. Moreover, under the terms proposed, Bushs initiative would permit large companies to emerge unscathed from the disastrous consequences of their own greed, but would not lend an ounce of aid to citizens who have lost their homes or are about to lose them, in the midst of the real estate crisis shaking the United States. In that respect, the bailout proposed by the White House also resembles the Fobaproa-Ipab operation designed and approved by members of the PRI and PAN parties in Mexico.

Beyond ethical considerations which have never been the strong point of the current US administration as well as electoral, political, and social concerns, it is all too evident that the approval of the proposed bailout by the still-president of the United States would impose a radical reorientation of public expenses, favoring stockbrokers and executives of large financial firms, paralyzing innumerable social programs and the creation of infrastructure, and consequently multiplying factors contributing to the recession of an economy itself affected by the housing crisis and high fuel prices. That is why this proposal of the sacking of the U.S. public treasury has a long way to go before legislative approval.

Although an acceleration of U.S. economic problems would have serious, undesirable repercussions throughout the world, and particularly in Mexico no matter how hard the highest Mexican authorities irresponsibly endeavor to minimize the worrisome connection one hopes that common sense prevails and that the steps taken to reorganize the U.S. financial sector, which undoubtedly remain necessary, emerge very different from the proposal the White House sent to the Capital last Saturday. Indeed, the proposal itself, viewed under the historical light of the trend of private appropriation of public funds that characterizes the current administration, may emerge as a last ditch attempt at pulling off a big deal by the business mafia surrounding the current president.

Leave a Reply

You must be logged in to post a comment.