Dear Editor,

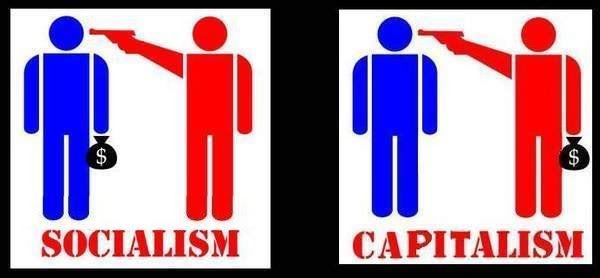

The explosion of the world financial crisis and the measures adopted by the United States and Europe to save the market are causing people to question not only the world financial system, but also the free market economy and the capitalist road. It is said that government market relief measures�the nationalization of banks, government acquisitions of bad bank assets, the injections of funds into banks, the purchases of bank stocks and government intervention in economic activities�are �socialist.�

Is this opinion correct?

Reader, Eastern River

Is this world financial crisis the inevitable result of the free market economy? People certainly have different opinions on the root of this world financial crisis. Some people believe that U.S. subprime mortgages and weak oversight led to the subprime mortgage crisis and its chain reaction, and that all nations have to make a concerted effort to save the market and to strengthen the oversight of the financial system. There are also people who believe that the financial crisis reveals existing flaws in the world financial system, and that besides saving the market and strengthening supervision, we need to reform the financial system itself. And then there are people who believe that the financial crisis means the failure of the free market economy and that we should limit market �freedom.�

These opinions all have different levels of reason, and many of the countermeasures have a definite positive significance. However, the author believes that attributing the root of the world financial crisis to problems with individual financial organizations and financial oversight lacks persuasiveness. Attributing the root of the crisis to flaws in the world financial system undoubtedly goes a step deeper, but simple reform of the world financial system itself cannot prevent this kind of financial crisis from reoccurring.

Without a doubt, the market economy model is the general foundation on which economic crises occur, but this world financial crisis is not the inevitable outcome of the market economy�rather it is the result of extreme distortions of the market economy and aberrations in financial relations.

After World War II, a series of significant changes took place in the market economy and in its financial relations:

The first was the symbolization, formalization and virtualization of money. The value symbol, in the form of paper money, separated from and even replaced the currency itself as a special commodity. Precious metals not only no longer served as a means of circulation, but also no longer served as a global currency�that function was now being played by the currency of individual developed nations.

The second was that capital became highly virtualized, and virtual capital was emphasized over real capital. Virtual capital as an ownership certificate became completely independent and was even in a position to control real capital and guide economic activities.

The third was the unlimited generation of financial tools and the unlimited

expansion of finance. Under the name of �financial innovation,� financial derivatives emerged one after another, constantly changing. The financial forms became leverized. �Shadow banking� was widely adopted and in order to stimulate economic growth, the ability to circulate funds expanded limitlessly. Because of these significant changes, all of these value forms bubbled extremely easily�the paper currency bubble, the natural resources products price bubble, the stock market bubble, the real-estate bubble, the GDP bubble� The false market prosperity concealed overcapacity and hidden financial risks. So to prevent a world financial crisis from occurring every century, we basically need to correct the distortions of the market economy and the aberrations in financial relations, develop gold�s role as the basis for paper currency and as a foreign exchange reserve and effectively control the spontaneous expansion of virtual capital and financial forms. But these kinds of changes do not change the �free� nature of the market economy�without free market activity there would be no market economy. What we need to change now is the specific model of the market economy; we do not need to replace the market economy itself.

Does the world financial crisis indicate that capitalism has reached the end of its rope? This world financial crisis is completely on par with the economic crisis of the late 1920s, but the author believes that seeing it as the arrival of the last days of capitalism really is sensationalistic. The financial crisis is an economic crisis in nature. This financial crisis is just a special manifestation and a modern trait of an economic crisis. The economic crisis is a manifestation of the inherent contradictions and self limitations of the capitalist mode of production.

More than one hundred years ago, cyclical economic crises would explode about every ten years. They were quite regular and went through the phases of depression, gradual recovery, prosperity, overproduction, crisis and stagnation. Their main traits and manifestations were just as Engels depicted: trade stops, the market brims over, large amounts of products become unsellable overstock, money gets extremely tight, credit stops, factories stop manufacturing, workers lack the means of subsistence because they overproduced the means of subsistence and bankruptcy after bankruptcy and auction after auction occurs. The stagnation state continues for several years and a large amount of production capacity and products are wasted and ruined, until finally a large amount of overstock is sold at reduced prices. Production and trade then gradually recover. The pace gradually quickens from a slow walk to a fast walk, then industry breaks into a run, which becomes a real horse race with industry, commerce, credit and speculation enterprises all running wildly. Finally, after several death-defying leaps, they sink into a deep abyss again. It repeats like this forever.

But today, because of the new developments in capitalism and new features of the market economy, an economic crisis is manifested more in the form of a financial crisis. However, it is premature to predict that capitalism is in its last days. The last major crisis caused the U.S. economy to regress 20 years as far as the total economic sum but capitalism did not decline because of it. The reason lies in the capitalist mode of production still having quite a bit of vitality. This world financial crisis will inevitably inflict heavy casualties and ruin the economies of the capitalist countries and even on the world economy, causing social contradictions to be more prominent, but it will still not be fatal. Actually, economic crises (regardless of whether they are regular or cyclical) are indispensable to the development of the capitalist mode of production. An economic crisis can intensify market competition and eliminate obsolete technology, production factors, enterprises and management, causing the capitalist production form to slim down and be revived. Thus, it is possible for the world to avoid a financial crisis that deviates from the normal course of market economy operations, but not an economic crisis itself. Perhaps American-style capitalism will have difficulty continuing, but capitalism will not die from one crisis.

Are the actions of capitalist countries to save the market socialist? Since the explosion of the financial crisis, the United States and Europe have adopted a series of measures to save the market: government injections of funds into banks that have sunk into difficulty, purchases of bad bank assets, the nationalization of banks that cannot pay their debts, and the continuous lowering of interest rates by large amounts, et cetera. As to the actual content, these measures are one of two kinds: the first is the nationalization of a small number of financial organizations; and the second is the expansion of the role of government intervention in the market.

Seeing these actions to save the market as socialist measures is, at the very least, a kind of misunderstanding, which does not come from Marxist scientific socialist theory, but post-developed nations practicing socialism. According to Marxist scientific socialist theory, a socialist economy reborn from a developed capitalist economy will have the following characteristics: society directly owns the means of production and joint production, joint labor and product-sharing are implemented and commodity production and value forms are no longer necessary. Society and production are a unified organization that has planned regulation. However, in backward countries practicing socialism, the beginning stages are substantially different from those Marx described. For a long time�not distinguishing between two different historical forms of socialism�we inaccurately summed up the economic characteristics of socialism as public ownership, distribution according to work done and a planned economy that we then implemented. As a result, they were inevitably manifested in distorted forms: public ownership took the form of the state (or government) ownership system, the planned economy took the form of the state management system and administrative distribution and the system of distribution according to work done became the �iron rice bowl�. In this way, nationalization and government intervention have almost become the measures and characteristics of socialism. This kind of thinking is incorrect.

Our forefathers pointed out early on that the joint ownership of land and means of production can exist in completely different production forms�joint ownership itself does not equate to socialism. Unavoidable nationalization includes economic progress, but nationalization itself is not a socialist step. The capitalist mode of production has two basic characteristics: the first is that on the basis of the generalization of commodity production, labor itself becomes a commodity, the means of production takes the capitalist form and labor takes the form of wage labor. The second is that the direct objective of production is surplus value.

Nationalization and government intervention are certainly limiting factors on private assets and economic freedom, but regardless of the kind of model capitalism adopts�the American model, the Japanese model, or the German model or the French model, and regardless of whether the level of nationalization is large or small, and whether government intervention is much or little, as long as there are not fundamental changes to the two basic characteristics described above, it is still the capitalist mode of production. Since this is the case, all of the actions to save the market and all of the reform measures revolving around this financial crisis may raise the level of civilization of capitalism, but they are not really able to shake the economic foundations of capitalism.

Leave a Reply

You must be logged in to post a comment.