In this article, which created havoc in Latin America, Alfredo Jalife-Rahme claims that the 0.25 percent interest rate increase has nothing to do with the U.S. economy but is the result of a global strategy. Among the consequences he foresees: serious economic problems in Latin America and the BRICS countries. If none of the Latin American countries seem able to react, Moscow could take matters into its own hands in the forthcoming days.

The Federal Reserve has finally ended the era of free money: a 0.25 percent interest rate increase sufficed. Nevertheless, collateral damages of cataclysmic importance, with profound geopolitical consequences, particularly in a catatonic Latin America, are now occurring.

The Fed is the only really global central bank; a conglomerate of private banks on Wall Street which applies state monetary policies on a federal level, due to the pernicious hegemony of the dollar. Thus it constitutes the supreme power at the locus of a multifaceted system of control comprising the Pentagon, Hollywood, media outlets and the cyber-group GAFAT, which stands for Google, Apple, Facebook, Amazon and Twitter.

Ambrose Evans-Pritchard, a heartless servant of the British royal house, analyzes the highly risky and bullish market venture run by the Fed and says, “The global policy graveyard is littered with central bankers who raised interest rates too soon, only to retreat after tipping their economies back into recession or after having misjudged the powerful deflationary forces in the post-Lehman world.” Evans-Pritchard is making reference to the Lehman bankruptcy of 2008 which resulted in a dire crisis in the U.S., and subsequently in the world, and which is currently still unresolved.

The examples cited by Evans-Pritchard substantiate the fact that after two failed attempts at increasing interest rates by the European Central Bank in 2011, the latter almost ended up collapsing the monetary union but was saved by the political turn-back of Sweden, Denmark, South Korea, Canada, Australia, New Zealand, Israel and Chile.

The increase is not a simple or inconsequential raise, but the Fed follows a singular pattern in which it plans to gradually raise interest rates during 2016 to reach 1.375 percent.

Can the world and the neoliberal country of Mexico withstand another four consecutive increases after the first one led to the bankruptcy of Ingenios Civiles Asociados, one of the main building firms of all Latin America?

The Financial Times, which runs the financial markets of Mexico with impudence and nerve, had unfortunately reported a rate increase of 3.25 percent two days before the interest rate increase was announced. The same newspaper concluded that the neoliberal Mexican economy was subjected to U.S. monetarist politics. In lieu of tightening monetary policy, the U.S. should have relieved pressure.*

The New York Times regrets that this “submissiveness” has entailed the devaluation of the Mexican peso by 30 percent in less than a week.

Even Stratfor, a consulting firm, which in reality and behind the scenes is the equivalent of the CIA for corporate companies, admits that the Fed behaves selfishly and unilaterally without caring for the cataleptic state of the rest of the world, which in my opinion affects mainly China and the European Union, two of the main drivers of global growth.

According to Peter Spence, a writer for The Telegraph, the countries most exposed are Brazil, Chile and South Africa. In addition, the emerging market economies could be particularly vulnerable since many of them have stocked an enormous amount of debt which could become unmanageable (e.g. the parasitic firm Grupo Monterrey including Cemex to Alfa).

Brazil and South Africa are among the several BRICS countries severely damaged, which substantiates the theory that the Fed has the collateral intention of hitting them hard, the same way it did Russia, which is suffering from the brutal decrease of oil supplies and where crude oil has plummeted to $35 per barrel, while the renminbi underwent a programmed devaluation of 30 percent.

Hence, this is how the multidimensional war the U.S. has decreed in order to corner the rest of the world functions.

Zhang Yi of the media outlet Xinhua reckons China might have to challenge the rate increase since it will need money to invest in high speed trains, satellites and high-tech products such as computers which China produces contrary to popular belief that it is solely the toy factory of the world.

Since hypocrisy dictates, Janet Yellen, the half Israeli and American chairwoman of the Fed,** whose vice-chairman is Stanley Fisher, ex-governor of the Bank of Israel, acted surprised when crude oil prices plummeted, although coinciding with the engineered interest rate increase, all the while admitting there are limits to which crude oil prices can fall.

She already pointed to the fact that the jihadis auction oil at $15 a barrel, stolen oil they sell to Israel.

Evans-Pritchard considers that the rate increase is well-timed, following four years of budgetary cuts and an unemployment rate which fell by 5 percent.

Beyond the trivial and boring monetary measures, we see a foggy horizon since U.S. industrial production is not going strong. The U.S. nominal gross domestic product is no more than a mediocre annual 3 percent. The job market is not as tight as it seems and many analysts consider that the Fed will track back.

Other analysts reckon that the real tour-de-force happened two years ago, when the Fed stopped purchasing $85,000 billion a month by virtue of quantitative easing.

Beyond the economists’ semantics and chimeras, which are almost always wrong, the real problem is the $9 billion worth of foolish foreign debt, which, since July 2014, entailed an unprecedented re-evaluation of the superdollar by 20 percent, and a slaughter of the emerging market economies which are extremely dependent on flattened raw material prices, especially with the current changing of regimes from Venezuela to Argentina.

Eight days after he became president of Argentina, the neo-liberal Mauricio Macri caused Argentine wealth to sink to the level of Equatorial Guinea, after a devaluation of more than 30 percent, according to The Financial Times; while in Brazil, the Israeli-Brazilian finance minister, Joaquim Levy, had to be relieved of his duty after obtaining the downgrade of treasury bonds in the most formidable economy of South America; a downgrade of indecent levels by the discredited Fitch.

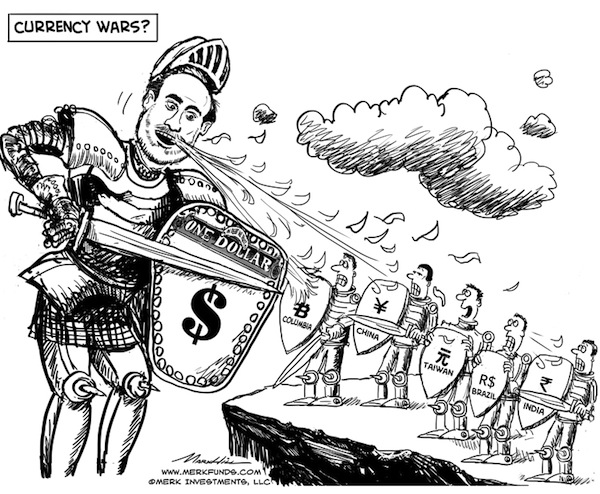

Are we witnessing a global currency war, planned by the Fed against a stunned world? The sole respectable re-evaluated currency has been the superdollar which has given a good thrashing to all its competitors.

The divergence is unpleasant. The U.S. is busy strangling us (by drying up the amount of credit which adds value to money) precisely when China and Europe are struggling to maintain a monetary lull, which by the way, implies a devaluation of their respective currencies.

Does it suit the U.S. to have a superdollar that is purchasing mainly emerging markets assets at an all-time low, such as Mexico, which soon enough will have to sell off its chief oil assets in the shallow waters of the Mexican Gulf in favor of four Anglo-Saxon oil firms (Exxon, Chevron, Shell and BP)?

Nothing is predetermined, and the Fed’s interest rate increase plunges the world into an ocean of unforeseen dangers.

* Translator’s Note: The original text implies that finance is so far removed from economic reality that the only thing that the financial world feeds on is communication stunts; that concocted reality based on media narratives is all the more dangerous and powerful considering the new, computerized language of artificial intelligence, i.e., algorithmic trading and high frequency trading, that is based on information. And so, one who creates the information runs the financial world.

** Editor’s Note: Janet Yellen is an American economist born in New York and is not an Israeli citizen.

Leave a Reply

You must be logged in to post a comment.