On March 27, 2020, the United States took first place in terms of the number of cases caused by the new coronavirus. The number of people infected in the country has surpassed 85,000 people. More than half of the cases are in the state of New York. This is just the official data. The real number of American cases could be significantly higher.

The New York Times published an interview with Colin Smith, an emergency doctor at a New York hospital: Not only are there not enough ventilators, but there is also a lack of basic protective equipment.

However, it’s not just the state of New York that has turned out to be underprepared for the coronavirus pandemic, but the entire country. The United States Conference of Mayors conducted a short survey of cities to assess the level of demand for vital protective equipment and supplies.

The responses to this survey were received on March 24 from 213 cities across 41 states and Puerto Rico. The populations of these cities range from under 2,000 to 3.8 million people. In six of the cities, the population is more than 1 million; in 45, cities it is below 50,000. In total, 42 million people live in the participating cities.

An analysis of the answers to the survey questions shows that 91.5% (192) of the cities do not have enough face masks for their first responders (including police, fire, and emergency medical technicians) and medical personnel; 88.2% (186) do not have enough personal protective equipment other than face masks to protect these workers; 92.1% (186) do not have enough test kits.

According to this survey data, 85% (164) of the cities do not have enough ventilators for use by health facilities in their city or area; 62.4% (131) have not received emergency equipment or supplies from their state. In those cities that have been receiving help from their state, 84.6% (66) say that this aid is not adequate to meet their needs.

The economic consequences of the coronavirus crisis could be catastrophic for the U.S. In this case, it is small businesses that are the most vulnerable, and they provide 85% of the jobs in the country. The pandemic could unravel all of President Donald Trump’s economic achievements, which will also have an impact on the result of the upcoming presidential election.

As such, this paints a very sad picture. In order to rectify the situation, on March 27, Trump signed into law the largest ever economic stimulus package, totaling $2 trillion, in response to the coronavirus pandemic.

Under this bill, the U.S. government will deliver direct payments and unemployment benefits to individuals, money for states and a large fund to help businesses suffering from the crisis. In turn, the U.S. Federal Reserve will buy up the bonds of American companies in the amount of $4 trillion.

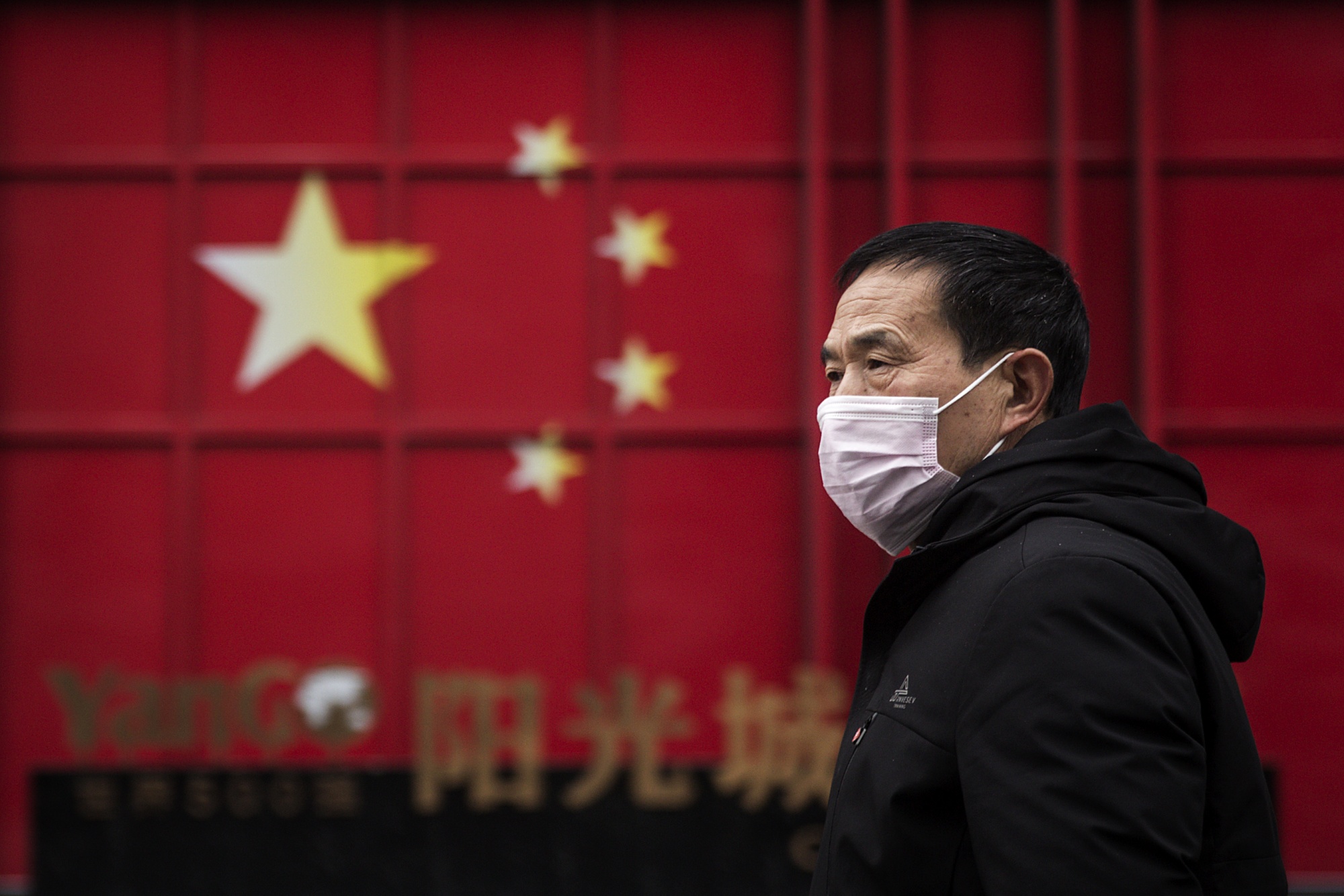

However, this does not include all of the economic measures with which the U.S. military-political leadership plans to solve the current problem. It has decided that China will provide compensation for the hits taken by American companies and the U.S. federal budget as a result of COVID-19. A federal lawsuit has already been filed against China, accusing it of the purposeful and selfish suppression of the coronavirus problem at the first stage of the epidemic. The lawsuit alleges that, as a result of actions by the Chinese government, U.S. companies dealing in foreign trade have been dealt a huge blow, and China should pay.

What’s interesting is that this lawsuit was filed by two major U.S. law firms: Lucas Compton, which is working on Trump’s reelection campaign, and the Berman Law Group, in which Frank Biden , who is the brother of Democratic presidential candidate and main rival Joe Biden, serves as a director.

The list of parties to the lawsuit clearly proves that a bipartisan consensus has been reached within the American elite regarding the issue of robbing China. In fact, this is a relatively unpleasant surprise for the Chinese government, which naively believed that Biden was pretty much their candidate.

The amount of damages being sought in the litigation against China has not yet been calculated, but there can be no doubt that we are talking about trillions of dollars. Consider this important detail: the law provides for interim measures of protection. To ensure recovery from the Chinese government, the U.S. can seize the property of Chinese government companies doing business in the U.S.

Moreover, China has invested approximately $1.1 trillion in government bonds in the U.S. It will be enough to simply freeze all operations involving these securities. We need to understand that the Chinese government has little chance of winning in an American court. The U.S. extended its national law beyond its borders long ago, and the U.S. Treasury Department has imposed economic sanctions on foreign citizens, companies and entire countries.

In the current situation, we can expect to see a strengthening of ties between China and Russia, as these countries have something to offer each other. For example, Beijing could replace all of the oil that it buys from Saudi Arabia with Russian oil. Accordingly, when seen against a background of a global decrease in the demand for oil, this will deal a heavy blow to Saudi Arabia, America’s puppet, as well as to the dollar as global currency.

Leave a Reply

You must be logged in to post a comment.