American churches that represent various religions and denominations – from Protestants and Catholics to Mormons, Methodists, Presbyterians, Quakers and Evangelicals – do not pay taxes from their “Godly income.” In a country where the precise payment of taxes is elevated to cult status in the everyday life for the average American, the special status of priests has [led to] multiple questions from the fast-growing atheistically-oriented population of the U.S.

According to American laws, churches, which are considered charitable organizations, do not pay federal, state or local taxes, and their pastors are also exempt from paying practically all “dues,” except for the tax on income for providing religious services. However, religious servants in the U.S. are loath to pay taxes due to religious considerations, then by writing a corresponding claim to the Internal Revenue Service, the priests may rid themselves from such a necessity.

Not only do American tax collectors not demand tax declarations from churches, they don’t obligate entities that lie between the world and the heavens to report their expenses, like in the case of secular non-profit and charitable organizations.

Even though some Americans attempted in different times to argue whether exemption of churches from tax laws of the country is constitutional, all attempts to impose worldly laws on divine ordinances ended with no results. The latest case was a lawsuit by a New Yorker named Waltz against the Tax Commission, which demanded an end to the actual forcing of citizens to subsidize churches in New York. This happened in 1970. The high-profile case even reached the Supreme Court of the U.S., which after doing some thinking, supported the legitimacy of “tax immunity” of establishments of worship.

Most churches in the U.S. are far from being poor. For example, today there are approximately 350 thousand churches in the U.S., and before last year, according to existing data, American congregations donated around $110 billion to their religious organizations. Protestants, which make up the majority of the U.S., donate one and a half times more than Catholics and members of other Christian denominations. And the federal government provides sizable assistance to churches by distributing multimillion dollar grants.

By the Way

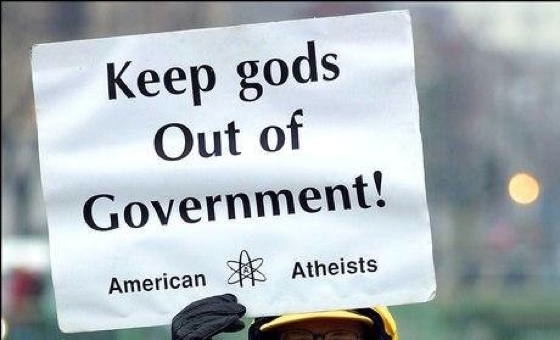

Even though the United States is traditionally considered to be a country with strong religious feelings among the population, the latest social research shows that the number of atheists is growing rapidly. In 1990, 8 percent of Americans disbelieved in a higher power in 1990; however, the amount of “the Godless” today has surpassed 19.6 percent, according to an October survey by Pew.

Leave a Reply

You must be logged in to post a comment.