America Is Significantly Cutting Taxes. China Should Take Notice, but Not Panic.

(China) on 4 December 2017

by (link to original)

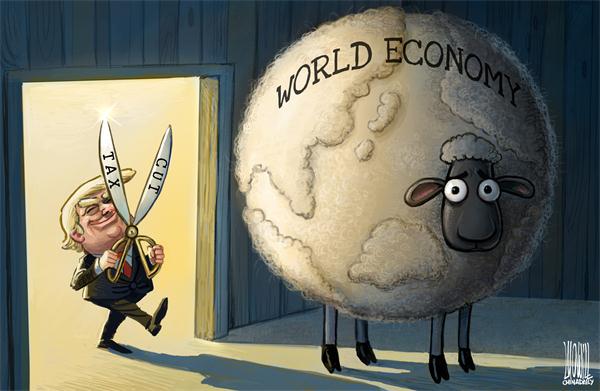

Because the U.S. is the world’s most influential economy, this tax cut bill will inevitably have some spillover effects. For some time now, the world’s other major economic powers have implemented (or have started exploring) measures to respond to the bill. Something like a “tax cut contest” situation will be difficult to avoid.

In recent years, controversies relating to tax burdens have been raised repeatedly in the Chinese media. At the end of last year, China was still making noise about the crisis of “the flight of Cao Dewang.”** The public continues to argue about whether the U.S. or China has higher tax rates, with no resolution in sight − tax rates have become a touchy subject. The news of America’s tax cuts has gotten people all riled up once again. Some people have been reviewing the April 2017 declaration from China’s State Tax Administration that called for vigilance against spillover effects from America’s tax cut plan, using the special language of the internet to mock China’s attitude.

In our opinion, we ought to analyze reasonably and objectively what the American tax cuts mean for other countries and what sort of spillover effects they will produce internationally. At the same time, we should support whatever response Beijing delivers to defend the economic interests of China.

Large-scale tax cuts are Donald Trump’s big act to revitalize the American economy. In theory, it will benefit companies by helping them to increase investment and attract capital, talent and other key economic resources from the international market. Trump’s goal is still to plug the serious drain of manufacturing companies, and bring the manufacturing industry back to the U.S. However, it is not at all certain that the tax cuts will bring about these desired results. Many other conditions will be required before the theoretical impact of the tax cuts can be realized.

The tax cuts may benefit both America’s wealthy and America’s middle class, but the basic logic of the plan is fundamentally the richer you are, the more benefits you get. Everyone will pay lower taxes, so the deficit will increase − it’s basic math – and there’s still no such thing as a free lunch. Everyone will share the burden of the deficit, and the result is that the rich will make money day and night, the poor will appear to make money but actually suffer from hidden losses, and ultimately the result will be ever-greater disparity between rich and poor.

Since the Trump administration released the news regarding tax cuts, the Chinese government and the academic community have already begun to discuss a response. In addition, the value-added tax, “Five Priorities,”*** and other measures that have been in place for nearly two years are also helping China respond to the impact of the U.S. tax bill. China’s tax code is very different from America’s tax code. The Chinese corporate tax burden is relatively large, and as such, it would be impossible for China to imitate America. That said, Beijing is paying close attention to any spillover effects from Trump’s tax cuts and will not remain indifferent.

This is a much more complicated situation than we saw after the “flight of Cao Dewang” crisis which riled public opinion. The total tax revenue America will realize is not accurately represented by the single tax cut from 35 percent to 20 percent. If that were the case, there would be no way that the American economy would collapse. But don’t forget, over the course of next year, Trump also wants to raise military spending by tens of billions of dollars. In addition, rumors about America’s tax cuts has leaked, setting off spillover effects abroad. The impact it will have on China’s economy may not be as large as some people think.

The position of the Chinese government is founded on our nation’s best economic interests, while many voices in the media contribute their own ideologies and use catchy slogans to attract people’s attention. In addition, the corporate community can have a relatively strong influence on public opinion, and so the media can easily end up echoing their interests − it is often hard for the public to tell the difference.

In summary, America has made its move, and China will surely respond. Just like the U.S., the Chinese government must also focus on maintaining the long-term superiority of its own country’s investment environment; it cannot allow this country to lose its competitiveness. The Chinese government has its hands on many regulatory levers, and we are very capable of implementing adjustments scientifically and rationally. The Chinese people should be confident that the challenges brought about by Trump’s tax cuts are not being ignored, and will certainly be responded to appropriately.

*Editor’s note: The tax cut bill was approved by Congress and signed into law by President Trump on Dec. 22, 2017.

**Editor’s note: This is a reference to a well−publicized story in the media about a Chinese billionaire who moved production for his business overseas to the U.S.

***Editor’s note: “Five Priorities” refers to a Chinese policy prioritizing reform in the following five areas: cutting overcapacity (“zombie” enterprises), reducing excess inventory, reducing corporate leverage, lowering business fees, and strengthening points of weakness such as poverty, failing infrastructure, disaster relief, etc.

/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fcard%2Fimage%2F673793%2F8f46ab8f-ca37-4595-bebb-29d401be8f1e.jpg)