During the first year of Donald Trump’s presidency, he has never lacked for attention thanks to domestic political battles and withdrawals from international agreements. The constant news surrounding him has almost made one forget that Trump won the presidential election by playing the economy card. How has he fared so far in managing the economy?

America’s latest economic data seem to provide some answers. Growth of the U.S. economy in 2017’s first three quarters is at 1.2 percent, 3.1 percent and 3.3 percent respectively, with the third quarter having the second fastest growth since 2008, second only to 5.2 percent from the third quarter of 2014. The labor market has also continued to improve, with all three indicators at historic highs. Not only does the U.S. have more total financial wealth than before the economic downturn; the average American household income has also surpassed the old peak number in 1999.

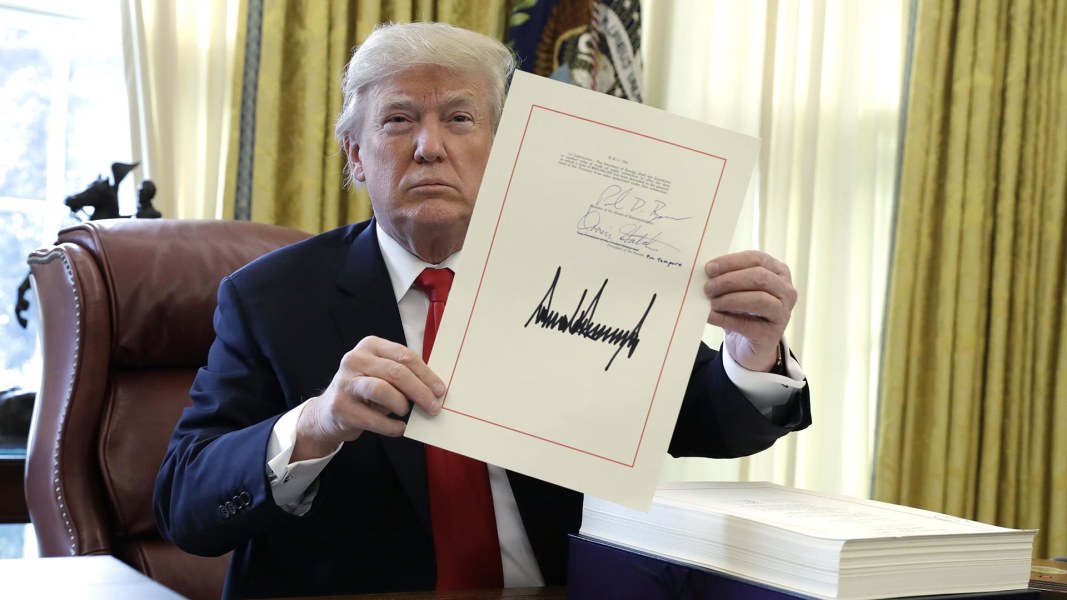

Not surprisingly, Trump has claimed that these achievements were due to his economic policies, but the facts show otherwise. So far, Trump is still executing the Obama administration’s 2017 fiscal plans. His biggest economic move, the tax cut plan, wasn’t revealed until September of this year. While it has passed both houses of Congress, it will be some time before it takes effect, and its results remain to be seen. At this point, Trump’s boost to the economy is mainly improving the confidence of businesses and citizens in the future.

What has really pushed the American economy in a good direction is the way the economy’s internal growth has been ignited after a long period of adjustment via consumption and private investment. The economy’s development potential has broken through the previous financial crisis and is leading the country into an expansive period.

Looking ahead, knowing Trump’s economic policies are aimed at relaxing both fiscal policies and currencies, should they take effect, the American economy would be revived in the short term. Cutting corporate taxes could encourage business to invest more, as will measures such as reducing government interference, replacing government monitoring with financial boosters, encouraging banks and financial companies to lend, etc. In addition, the Trump administration may ask for increased enforcement of trade laws, attacking so-called unfair international trade practices, which are in fact curbing international products and businesses and paving the way for American businesses and “Made in America” products. Furthermore, in choosing the next Federal Reserve Board chairman and trustee candidates, Trump has tried to nominate officials who share his economic beliefs in order to reduce the Fed’s independence with respect to its currency policies and to make the agency more favorable for business.

While we’re anticipating some of the positive effects of Trump’s economic policies, we should also be concerned with the enormous risks hidden within them.

First, the present debt situation could become worse. So far, reducing taxes would not be able to achieve Trump’s so-called income neutrality. According to the American Tax Policy Center, if Trump’s tax cut were enacted, the federal government would have $2.4 billion less in income in the next 10 years, and the deficit would rise from the current 2.9 percent to between 4 percent and 5 percent of the gross domestic product.

Second, a lack of government monitoring could make the expedite the next financial crisis. Since the 2008 economic downturn, the Fed and the Treasury Department have worked closely with the federal government to increase financial regulation and protect the integrity of the financial system. However, Trump believes that strict monitoring of financial organizations has reduced Wall Street’s ability to innovate and has increased the cost of economic operation, so he has actively pushed for reforming financial regulation. With Trump’s cheerleading, the under-monitored capitalist bonanza in America could breed a new crisis before the old crisis has completely ended. The current American stock market is cultivating an even bigger financial bubble. More and more people are concerned that Trump’s economic policies will create a new mirage and accelerate the next crisis.

Third, Trump’s policies have limited effectiveness in improving productivity. A country’s productivity is the fundamental driver of its economy; only when American productivity drastically rises can Trump’s campaign promise of “Make America Great Again” be realized. But Trump faces the predicament of both a continued slowdown of productivity growth and lack of a labor force. The slowdown in manufacturing is particularly apparent, at an average of 4 percent from 1990-2000, to an average of 4.7 percent from 2000-2007, and down to 1.6 percent from 2007 to 2016.

Trump may have bragged about fulfilling his campaign promises, but we have not seen any direct or effective policy measures that favor raising productivity. Tax reform and infrastructure construction plans have not yet been put in place. In the fiscal budget for 2018, Trump has not made any investment in education or science and technology, which are fundamental to boosting productivity. In fact, he has made drastic cuts in these areas. Cutting investment in research and development and education is cutting a country’s future. In a country already plagued with stagnation, if similar cuts continue, the instability of American society will only increase.

Trump called the 2018 fiscal year “beginning a new chapter of American greatness,” but unfortunately, he has made “America First” into “America Superior” with his endless fracturing of American society. He has been inundated by domestic political crises; he has used his limited energy and time in calculating how to force other countries to open up their markets, to increase American exports and to disrupt the American-led-and-built international economic order, all of which have diverged from the promised path to “Make America Great Again.”

The author is the director of the Economy Research Office of the American Institute at The China Institutes of Contemporary International Relations, a visiting scholar at Harvard University and a member of China’s Young Talent of 2014.

Leave a Reply

You must be logged in to post a comment.