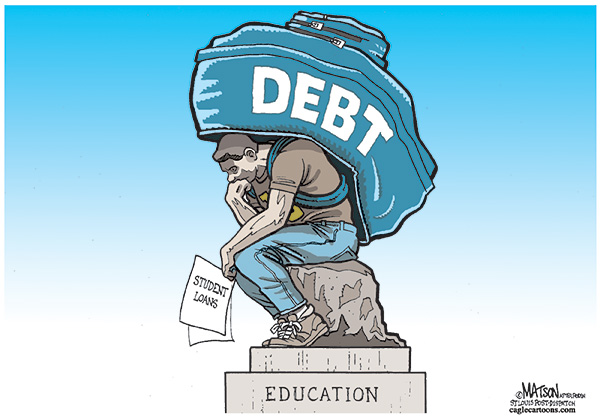

Capitalism is not just subprime mortgages. In 2010, student debt in the U.S. surpassed credit card debt. Today, together with Treasury bonds, education is the greatest speculative bubble in the world. Is this a scenario that awaits Italy as well?

“You want the government to loan you money? Don’t be a student, be a bank.” This provocation came from an American senator who was commenting on an unbelievable piece of news on her website in the fall of 2013.

With $864 billion in federal loans and $150 billion in private loans, student debt in the U.S. is more than $1 trillion today. Unemployed and underemployed graduates cannot repay their debts. Under 30 years of age, a failed, or better yet bankrupt, generation exists today. Like a company, or maybe a bank: Take Lehman Brothers as an example. Thirty-seven million people with a college or high school degree are not able to repay debts plus interest, which they had to sign under contract with the federal authorities or specialized corporations for paying off an education that is not free in the Anglo-Saxon world (Canada, as in England).

According to the New York Federal Reserve Bank, as regards student debt, since the first semester of 2012, the steady average of loans to students of all ages has been $24,301. Around a quarter of the borrowers owe more than $28,000; 10 percent owe more than 54,000 euros; 3 percent owe more than $100,000; and 167,000 people owe more than $200,000. Among 37 million young debtors, 14 percent (around 5.4 million) under 30 have applied for loans in the past to pay for their studies.

For every student who does not manage to repay his debt and declares bankruptcy, at least two other debtors become delinquent. In other words, they have lost everything they had and are forced to become criminals in order to survive. This reality does not just apply to recent graduates, but also to all those generations that lead a life obsessed with the idea of repaying educational debts. More than 10 million [debts] are among those who are between 30 and 39 years old; 5.7 million are among those between 40 and 49 years old; and 2.2 million are among those older than 60. As a side effect of the subprime financial bubble bursting, in 2010, student debt surpassed credit card debt.

In 2011, it surpassed automotive loans. Alongside the new financial bubble of Treasury bonds — some have called it the biggest bubble in economic history — the student debt bubble, which grows by $3,000 per second, could also burst.

This scenario converts life to the pace of those who are indebted and represents the “normal” state of financial capitalism. You want to enter the middle class? You must study. But if you want to study, you have to pay for a quality education, which costs thousands of dollars (often hundreds of thousands). Your family has no money in the bank; it turns to a bank after having taken stock of its financial situation at the kitchen table. If you go into debt, you have to pay it off with your labor. But what do you do if you are unemployed, intermittently employed or poor?

This is the paradox that the former middle class, which has become the “dangerous class” today, has been living for more than a decade. In the last five years, American students (English and Japanese) have not just been sitting there. There have been many counter-informational campaigns: “Occupy Student Debt” created a platform for disclosing these horrors. Organizations like Rebuild the Dream, Education Trust and Young Invincibles followed suit. President Obama approved the “Pay as You Earn” program, which expands payment periods for the indebted. The Support the Student Loan Forgiveness Act petition has asked for debt cancellation.

But today, debts only get forgiven for banks, not students. Life goes on, waiting for the liquidating commissioner or Equitalia.

Leave a Reply

You must be logged in to post a comment.