The man who executed the biggest fraud the U.S. has ever seen has just been arrested by the FBI in New York. Bernard L. Madoff, former Nasdaq President and one of the contributors to the financial crisis that began in September, was behind the pyramidal “Caritas type”* scheme through which he cheated investors out of about 50 billion dollars, as assessed by the Federal Prosecutors. Madoff would attract investors by promising huge profits, which he paid off out of what other people gave him, but couldn’t just keep rolling into his investment fund. The FBI has only one thing they can accuse him of – stock exchange fraud – but the evidence they’ve gathered could sentence Mardoff, now age 70, to 20 years in prison.

If the financial crisis hadn’t emerged in September, which made some investors ask for their money back threatening a global recession, perhaps the fraud’s scheme would have worked for a couple more years. Bernard L. Madoff Investment Securities, the firm that was dealing with the Ponzi scheme, was highly respected because of its founder, and bragged about a capital of $700 million on its website.

Tens of Thousands of American Banking Layoffs

The good news is that the FBI has finally started its “clean-up” among the financial U.S. big shots but that coincides with the news that the Bank of America will have to lay off 35,000 people. The layoffs will take place over three years, while Merryll Lynch is being taken over by Bank of America.

The two banks have already laid off a couple thousand workers, especially in the area of investment. Still, the “Daily Mail” cites optimistic economical analysts who see the current layoff as a “lesser evil.” Altogether, the acquisition of Merrill Lynch for $50 billion saved a lot of jobs. This way the jobs of 380,000 Bank of America employees will be saved after the restructuring.

While market quotes drop (around 11%-12% on Thursday), all the banks in the U.S. have announced layoffs. JP Morgan is laying off 10% of its employees (7,000 people), along with 9,200 from Washington Mutual, the bank Morgan bought in September. Goldman Sachs and Morgan Stanley have announced similar layoffs which affect about 10% of their personnel.

California Loses $1.7 Million Every Hour

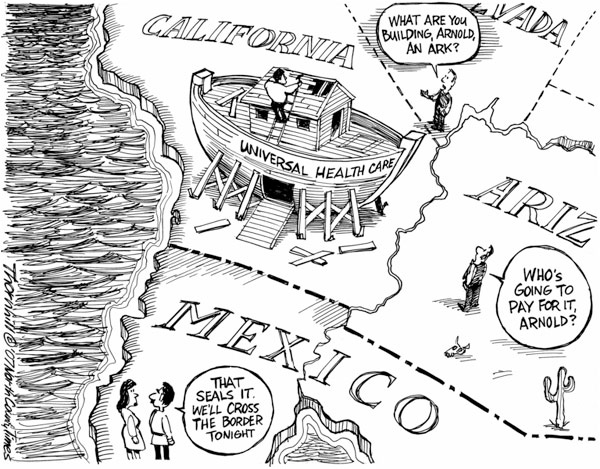

Even if it ranks as one of the eight great world powers, the state of California would be as close to bankruptcy as if it were an island apart. In February, there will be a financial Armageddon which may make the state incapable to operate.

In 2003, the current Republican governor, Arnold Schwarzenegger, was voted in to save the state from a similar budgetary deficit. This time, however, state authorities seem to lack the means to stabilize the budget. One of its most important sources of budgetary income is property taxes, calculated on the value of property. Until a few months ago California real estate sold for a “small fortune,” but today the Chinese are buying the houses for close to nothing.

Local legislation forbids increasing real estate taxes by more than 2% a year. Even if the law had a good basis, there have to be transactions which the state can tax. Apart from minor exceptions, real estate transactions are blocked.

Wednesday, Governor Schwarzenegger showed the media a graph of the dangerous pace at which California’s debt is increasing – $470/a second, $1.7 million/an hour and $40 million/a day – by announcing that it has to cut five billion worth of investments planned for 2009. The construction of schools, roads and other infrastructure elements will be at a halt as its creditors told the governor that his state is the least solvent of all American states.

*Translator’s Note –

Caritas was a Ponzi scheme in Romania which was active between April 1992 and August 1994. It attracted millions deponents from all over the country who invested more than a trillion lei (between one and five billion USD) before it finally went bankrupt on August 14th, leaving a debt of 450 million USD.

Leave a Reply

You must be logged in to post a comment.