US-Sino Trade Dispute Deadlock ‘Politicized’

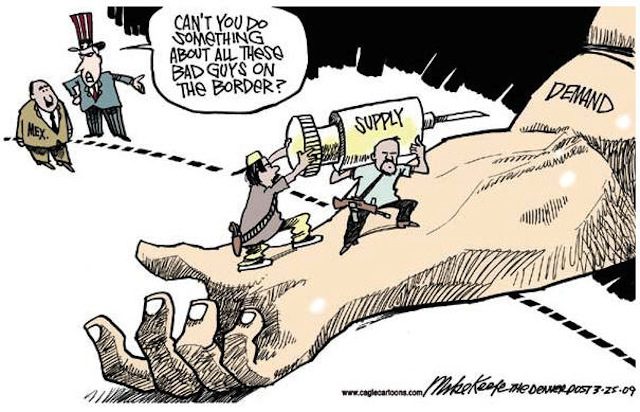

But according to experts familiar with U.S.-Sino trade relations, the imbalance in U.S. trade relations has certainly not been caused by China’s exchange rate policy. Rather, it is due to global economic structures and comparative advantages. U.S. foreign trade has long experienced a trade deficit; it was in a state of deficit before the U.S. and China established relations due to the structure of the U.S. economy. As globalization pushed forward, the U.S. economy experienced major and profound structural adjustments in having to bear manpower costs and land prices, and its comparative advantages were therefore adversely affected. An increasing number of U.S economic activities and manufacturing industries moved abroad and products were shipped back to the U.S. thanks to cheap prices. This is the main driving force behind the U.S. trade deficit. U.S. companies investing in China have contributed to a large proportion of the U.S. trade deficit with China stemming from the low price of Chinese commodities, which also helped the U.S. alleviate the pressure of inflation. Thus, China’s trade surplus is, in fact, the profits gained from American businesses and consumers.

The problem is that there will inevitably be a few in American political and governmental circles who do their utmost to politicize U.S.-Sino trade relations. Since the beginning of the Bush administration, the U.S. has made a forceful attempt to blame its trade deficit with China on China’s renminbi exchange rate policy. Is that really the case? If we look back on the changing circumstances of China’s renminbi over the past 10-plus years, it is not hard to see that the exchange rate for converting the U.S. dollar to renminbi has already grown from around 1:8.2 to 1:6.5; hence the appreciation of the renminbi cannot be said to be small. And what is the result? Not only hasn’t the U.S. financial deficit with China not decreased, instead, it has rapidly increased, and the U.S. dollars that China holds in foreign exchange reserves have also suddenly increased in value. The is because even if the renminbi appreciated in value against the dollar, this would not influence U.S. imports of Chinese goods. The greater the rise of the renminbi, the higher the U.S. financial deficit with China. This not only increases the trade deficit, but also increases costs to the American consumer; the gains do not make up for the losses.

The U.S. has many established U.S.-Sino relations think tanks and research organizations, and they all understand that U.S.-Sino relations are mutually beneficial. But it is difficult for these think tanks and organizations to change the minds of those who do not understand this. Some even have politically motivated superficial opinions, and thus, the U.S.-Sino trade relationship is frequently reduced to being the sacrificial victim of U.S. political battles. According to U.S. politicians, sacrificing Chinese interests does not cost any political capital; the politicians preside over the fairness of U.S.-Sino trade relations, and yet are also the ones who find themselves under political siege, and this is the truth behind the disharmony of U.S.-Sino trade relations.

Since China joined the World Trade Organization, the scope of China’s foreign trade has greatly expanded, and this is thanks to its clear advantages and suitability for the vast global markets. Part of China’s rapid expansion in terms of foreign trade over the past decade has been its steadily increasing trade with the U.S., which has jumped from less than $100 billion to more than $500 billion. In comparing the rapid growth of U.S.-Sino trade relations, we can see that the system which governs relations has not fundamentally changed in all this time and this has intensified the friction around trade, leading it to become a victim of U.S. political battles. As a result, the fundamental deadlocks in U.S.-Sino trade disputes are political.

At the present time, we can only rely on high-level interaction between both countries’ governments, and this is insufficient to resolve the problem of politicization because both countries are restricted due to domestic political pressure when participating in discussions and negotiations. For this reason, the U.S. and China might as well consider displaying the zeal of their respective business worlds to allow those who engage in U.S.-Sino trade to have a say - for example, Alibaba’s Jack Ma (Ma Yun) and Microsoft’s Bill Gates, who clearly understand the importance of U.S.-Sino trade and are capable of rationally reviewing U.S.-Sino trade disputes - but this could also be politicized. At the same time, the U.S. and China still need to cooperate to develop the third market and push for reform of international trade systems. By working together in mutually profitable situations, the two countries can develop trust in each other, increase their understanding of one another, and develop the future of U.S.-Sino mutually profitable ‘win-win’ relations.

The author is a professor in the Department of International Relations at Tsinghua University.