Edited by Louis Standish

On Thursday, the president announced a ‘Financial Crisis Responsibility Fee’ for the largest American banks. For Jean Charles Rochet, from the Toulouse School of Economics, although the plan is a nice surprise, it has little chance of being adopted.

What do you think of the plan unveiled yesterday by Barack Obama to impose a tax on banks (Financial Crisis Responsibility Fee)?

It’s an excellent surprise. Until now, the American President has been very unsure, reticent even, with regard to financial regulation. Certainly, Barack Obama was busy with health care reform and could not tackle everything at the same time. But today, he has demonstrated real political impetus.

What are the chances of this reform being passed by the U.S. Congress?

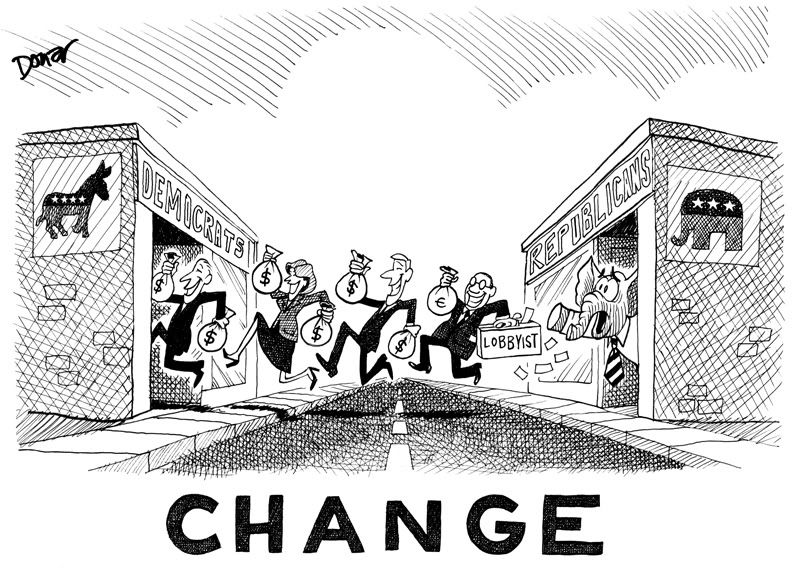

The chances are slight. I’m very skeptical about the willingness of the American Congress to approve this plan. In fact, the American system is very contaminated. Congressmen are influenced by very powerful and distorted lobbying. Broadly speaking, to get elected in the United States, one must have huge support from large banks and pharmaceutical industries. Actually, despite the trauma of the Wall Street losses, Americans still have complete confidence in the markets and remain very wary of public regulation. While they may admit that there was significant interventionism at the time of the crisis, they are reluctant to accept the benefits [of regulation]. Therefore, it would not be surprising if lawmakers vote for a less ambitious plan in the end, such as a yearly tax on bonuses for example.

However, if the tax were to be adopted, what would be the real consequences?

This tax is primarily symbolic, as opposed to an actual transformation of the system. In fact, the aim is to charge the banks the billions of dollars that came from public funds spent during the crisis. But in reality, the tax will not enable a reduction of bonuses or salaries; only bankers can decide to put a stop to their excesses, and for now they do not seem to be ready for this. In Great Britain, for example, banks prefer to pay the tax on the bonuses rather than reducing the amount of the bonus. Nor will Obama’s tax resolve the issue of public funds and risk exposure, however urgent.

Why not?

Today, the only way to reduce risk taking would be for the banks to reduce the extent of their speculative activity, particularly on derivatives. Yet for this to happen, regulation as a whole must be reformed. Notably, we would have to compel banks to increase their capital according to their exposure to risk, something which no one seems willing to accept. The Basel Committee is certainly working on these issues, but overall it is only managing to pass minor reforms on a small scale.

Obama has asked other countries to follow his initiative. Is this conceivable?

Once again, things are not moving quickly, but they are moving in the right direction. The fact that Obama supports financial regulation will inevitably be of benefit to greater international cooperation. In addition, other countries such as France and Great Britain also seem determined to take action in this area. But the problem remains the same; if one country does not follow the rule other countries have nothing to gain from following it either, since they risk losing their appeal, thus resulting in companies relocating. As long as countries remain driven by their national self-interests, then declaring their intentions serves no purpose.

Leave a Reply

You must be logged in to post a comment.