What does the record high for the Dow Jones mean? That we have reached the end of the crisis? Everywhere? Just in the United States? That we have returned to 2007, just before the start of the mortgage crisis?

No.

None of those. Sorry for getting your hopes up.

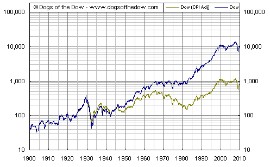

Firstly, the Dow Jones has not set an actual record. It has set a nominal record. It reached 14,164.53 points Oct. 9, 2007. But this figure is not in real terms. This is because prices have risen since Oct. 9, 2007. If you take the current Consumer Price Index (CPI) into account, then the Dow Jones peaked at 15,731.89 points in 2007; if you deflate it for GDP, 15,360. In the first of these cases, the Dow Jones is currently still 10 percent below the record; in the second, 9 percent below. For example, it is like rejoicing because you are going to pay the same as you would have in 2007.

In fact, in real terms, the Dow Jones is still below its level in 2000 during the dot-com bubble.

The figure above (that only shows through 2010) reveals the difference between examining the index alone and taking inflation into account. The upper line is the Dow Jones Industrial Average value without the CPI included in the calculation.

However, it could also be said that the Dow Jones had already broken the nominal record in 2012. How? By looking at dividend rates — the shares of profits given to shareholders by companies.

Businesses are giving more and more to shareholders because they have more money than they know what to do with. They will not invest it, because the United States’ economy is continuing to grow at a snail’s pace, the European economy is heading toward eternal stagnation like Japan’s and the Chinese economy is slowing to the point where today Beijing admitted that the country will probably not be able to meet its objectives for growth this year (welcome to the club). The calculation of dividends is much more complicated, but all analysts agree that, if dividends are taken into consideration, the Dow Jones is now higher than in 2007. But, again, this is without taking inflation into consideration.

So has the market not beaten any records? Or at least not any meaningful ones?

Exactly. The confusion draws attention to the method used to calculate the index. Initially, the Dow Jones Industrial Average was simply the mean average of the 30 stocks of which it was comprised. Later, the system was changed. But the price of the stock is still valued more than its market capitalization. This means that the movements of companies with expensive stocks have a larger effect on the index than those of companies with cheap stocks. If a company has many cheap stocks and is really the more valuable company, it will weigh less in the Dow Jones than another that has fewer but more expensive stocks.

There are other problems, too. The Dow Jones only counts the stocks of companies that are listed in the NYSE. It does not include the stocks in the other large NY market, the NASDAQ.

It leaves out, for example, Google, whose stocks have fallen around 14 percent over the course of the year and are worth approximately $1,000 dollars a share. Or Apple, whose stocks have lost around 15 percent since the start of the year, still going for about $433 dollars a share. Apple, for example, is worth 312 billion euros; Google, 212 billion euros, although the stockholders have very little power because the founders and the president control most of the company. The software giant Oracle also is not in the Dow Jones, although it’s valued at 123 billion euros.

However, Hewlett Packard, which is barely worth 31 billion euros, and Du Pont, which is worth 34.6 billion euros, are included in the Dow Jones.

This explains why the index of the Standard and Poor’s 500 is considered more reliable; it takes into consideration the share prices and the market capitalization of the companies in the NYSE and the NASDAQ. The S&P 500, as it is known, has not yet beaten its nominal record.

It is important to point out this distinction: Right now, the American media is insisting that the stock exchange has set a new record, and that this is the perfect occasion for inexperienced small investors to enter the market. These people could end up losing everything they have. As the old saying goes, “sell when the widows and the orphans buy.” Widows and orphans, it is supposed, are conservative investors with little experience. If they are entering the market, then something is going wrong.

Leave a Reply

You must be logged in to post a comment.