US Debt Has a ‘Ceiling’ but Party Disputes Have No ‘Floor’

(China) on 20 April 2023

by Ye Shuhong (link to original)

The so-called “debt ceiling” is the maximum amount of debt the U.S. Congress sets for the federal government to meet the payment obligations it has incurred, and to reach this “red line” means that the Treasury has exhausted its borrowing authority. Once Congress agrees to raise the debt ceiling, the Treasury can then meet existing payment obligations by issuing new debt. In December 2021, Congress passed legislation to raise the federal government’s debt ceiling to approximately $31.4 trillion, and on Jan. 19 of this year, U.S. government debt hit its statutory limit and could no longer be financed through bond issues. To prevent a government shutdown and debt default, the Treasury can only continue to pay civil service salaries, social benefits and interest on existing debt through unconventional accounting methods, but the cash generated from such “extraordinary measures” may be completely used up by June — and so far, there has been no bipartisan agreement between Democrats and Republicans on raising the debt ceiling.

Issuing bonds to cover the federal budget deficit has become the norm in American public finance. In theory, with the dollar as the international reference currency, it is not difficult for the U.S. government to issue bonds for financing, and as long as it keeps raising the debt ceiling, borrowing anew to pay back the old, the likelihood of the U.S. defaulting on its debt is very low. In fact, Congress has raised the government debt ceiling hundreds of times since 1939, from $45 billion to $31.4 trillion by 2021. The federal debt ceiling has now been reached once more, and it is likely that Congress will raise it yet again, but before it does so, the extortion drama of partisan struggle must be played out. A few days ago, Republican Speaker of the House of Representatives Kevin McCarthy spoke at the New York Stock Exchange, blasting the government’s debt problem and calling it a “ticking time bomb” that would “detonate” if “serious, responsible action” was not taken. Senate Majority Leader and Democrat Chuck Schumer countered that McCarthy was leading the country into catastrophic debt default and demanded that Congress raise the debt ceiling unconditionally.

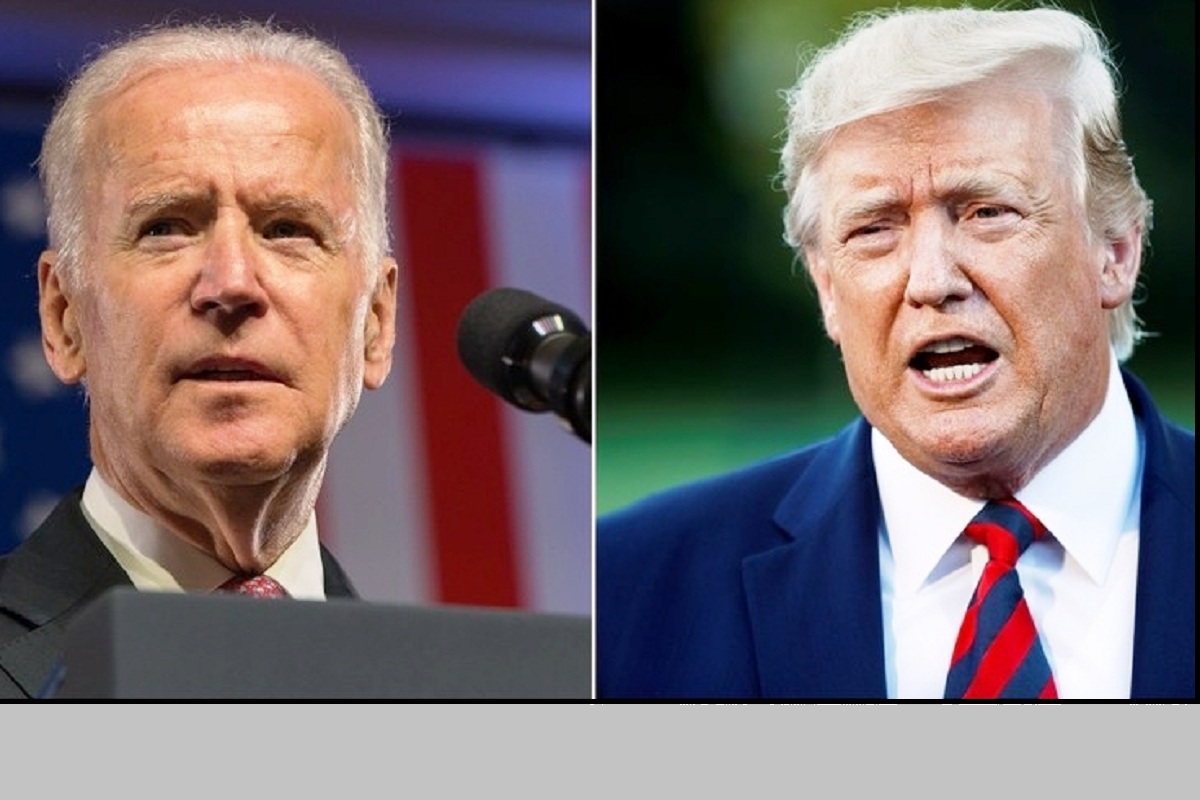

In fact, for most of American history, raising the debt ceiling has been a matter of routine bureaucratic procedure. But in the last decade or so, as social tensions in the U.S. have increased, political polarization has grown, partisan strife has intensified, and the issue of the debt ceiling has been used more and more frequently as a bargaining chip in political games. When this occurs, the interests of the people are completely ignored: According to Reuters, there has not been a day this year when U.S. lawmakers have not argued over the debt ceiling issue, with Democrats pushing for a quick, no-strings-attached increase, and Republicans wanting a significant cut in government spending before talking about the ceiling. The Democrats are accusing the Republicans of holding the economy hostage and wanting to shift Americans’ Social Security and medical insurance funds, while the Republicans are accusing the Democrats of being irresponsible. The Associated Press commented that in an era of partisan polarization in the U.S., and as the debt burden continues to grow, the debt ceiling is gradually evolving into a means of political attack. The two sides are engaged in a tit-for-tat Mexican standoff, full of complex calculations of interests and political gamesmanship.

Political drama surrounding the debt ceiling has played out repeatedly, and the American political arena has long been a battleground for partisan interests. When in power, they overspend heavily on the budget in order to please their constituents, and after leaving office, as opposition parties, they try to block the passage of debt ceiling bills, creating obstacles to the ruling party’s administration and extorting more benefits for themselves, putting partisan interests above the interests of the country and the majority of the public. For the American public, the debt ceiling crisis will have an immeasurable impact on all aspects of their daily lives, including medical reimbursement. At the same time, this crisis is occurring at a time when the U.S. economic recession is expected to increase, casting a shadow over the country’s economic outlook. In 2011, then President Barack Obama and House Republicans reached a last-minute agreement on the debt ceiling, narrowly averting a disaster, but the resulting tensions triggered severe volatility in global capital markets and led directly to a downgrade of the U.S. sovereign credit rating by Standard & Poor’s. In 2013, a bipartisan stalemate in debt ceiling negotiations over social welfare cuts and health care reform led to the government shutting down for half a month. The same drama is playing out again this year; Rachel Snyderman, senior associate director of the Bipartisan Policy Centre, an American think tank, believes that the bipartisan struggle over the debt ceiling could be the biggest threat to the U.S. economy this year.

The debt ceiling farce is just a microcosm of the polarization of American political life and the deterioration of the political ecology. According to congressional voting records, the U.S. is in the midst of its most politically polarized period since 1789. American political scientist Francis Fukuyama lamented that “not since the late 19th century has the ideology of both parties been as extreme as it is today.”* In the American society of today, the fissures in ideas, interests, race and culture continue to widen, and the various political groups are struggling to work together on a wide range of issues, moving instead toward bitter opposition and giving rise to unimaginable chaos in democratic governance. It is foreseeable that it will only be a matter of time before the Democratic and Republican parties reach a compromise on the debt ceiling, but the partisan struggle over many more issues will continue unabated, constantly revealing the new “floors” to American politics.

*Editor’s Note: Although accurately translated, this quote could not be sourced.